My posts this month were few and far between, but I am working on another post for a long time now (which is admittedly going to be a biiit large). All this scanning of data contributed to me stumbling upon a quite interesting piece of data.

The macro version of the investment rate (=investment/value added at factors cost) is a rather interesting indicator.

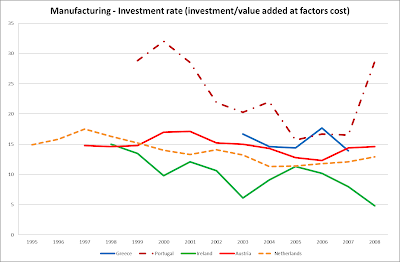

If one looks at data for EU countries she/he is bound to notice a quite pronounced divergence. Namely, investment rates for manufacturing firms are much higher in Central and Eastern Europe (CEE) than in western European countries. Here are some charts to help us visualize that.

|

| source: Eurostat |

|

| source: Eurostat |

Unfortunately, data for some countries are severely limited, but I think that the message they convey gets across anyway.

Here come Central and Eastern European countries (CEE).

|

| source: Eurostat |

And here are the Baltics.

|

| source: Eurostat |

Why is this particular data point so important? An increased channeling of earnings in investment on behalf of manufacturing firms can signal the existence of potentially profitable investment opportunities. Of course, things are never as simple as that and a number of factors could have contributed to that large differential in investment rates. Different ownership structure between companies of different countries (privately held vs. public companies where shareholders might push for larger dividend payouts), different regulation concerning distribution of profits, different practices in corporate governance could all have played a role. Moreover, the degree of capital intensiveness of each country's manufacturing sector surely plays a part. Furthermore, limited access to bank financing or other forms of financing could force firms to finance investment internally.

The fact is though that during the years for which data concerning CEE countries are available most of these countries were witnessing credit booms, so the lack of bank financing argument is losing some of its shine.

Moreover, I doubt that CEE manufacturing sectors are more capital intensive than hteones of western EU countries.

This was supposed to be a short post so let me wrap this up. The observed differential in investment rates among western EU countries and CEE countries is first and utmost a differential in dynamism between the manufacturing sectors of the said countries.

P.S. Of course, human nature (I.e. greed) makes sure that along with perceived opportunity comes exaggeration. Could this boom in fixed investment in CEE countries have had some bubble-ish characteristics? Well, how should I know about that…

P.S.2. Let me take this chance and wish all you brave ones that read this post (and of course those of you that didn’t) a happy new year. Let the new year be a good one…

No comments:

Post a Comment